During “normal” times, credit provides a means for consumers and businesses to make purchases and investments when they’re short on cash. If used responsibly, credit cards can also be a good way to accumulate travel rewards and take advantage of cashback deals. Sadly, these are anything but “normal” times.

The Effects of COVID-19 on the Credit Industry

The COVID-19 pandemic is hitting consumers and businesses all across Canada and the rest of the world. Reports estimate that Canadian unemployment stands around 7.5%, the highest rate the country has seen since the 2008 economic crisis. As a result, many consumers need to fall back on credit while they await unemployment benefits.

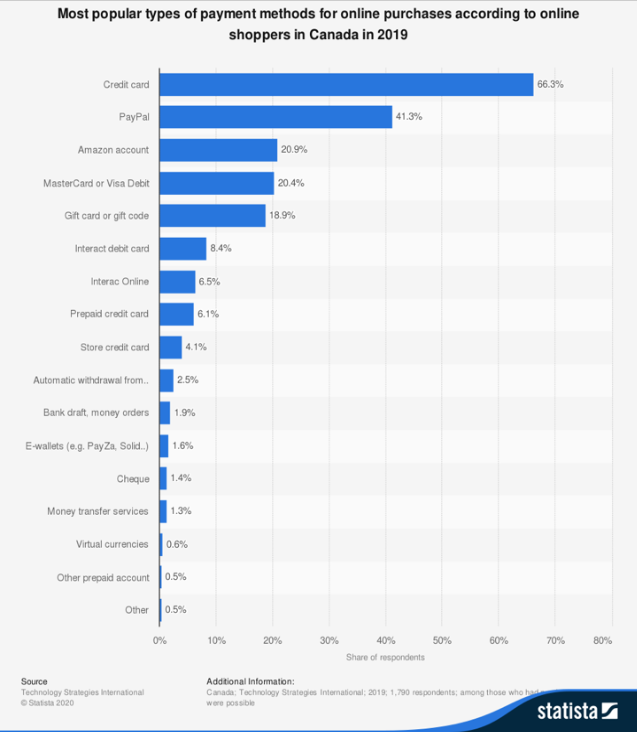

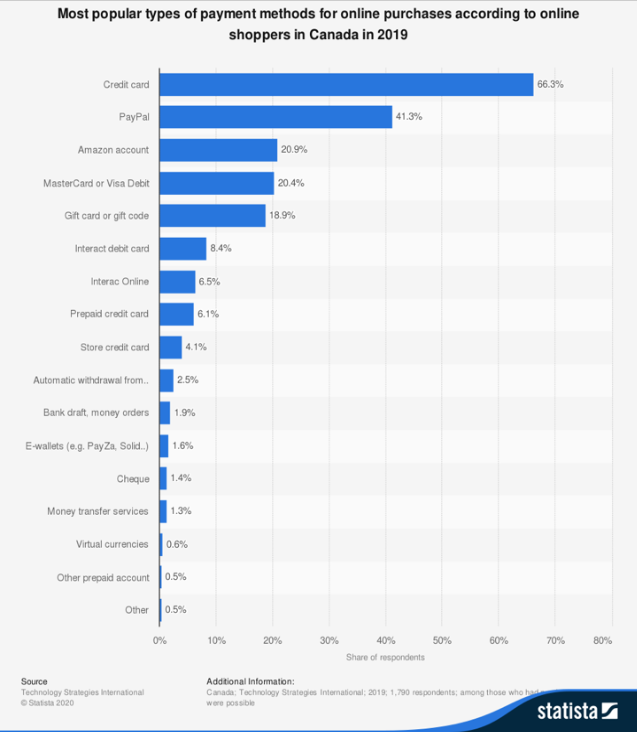

The Coronavirus has forced many to live their life online, safe inside their homes. Businesses have been forced to reexamine their online platforms to successfully ride out this wave. Since shipping services are deemed essential services, buying goods online has become the go-to outlet for much of the population. It would not be surprising to see a jump in online credit card use for the first quarter of 2020 (and throughout the year) as compared to 2019. According to a study by Canadian Payments Insights, a company offering analysis into the payment habits of Canadians, in 2019 “credit cards were the most popular payment method for online purchases in Canada.” Canadians used credit cards for more than 66% of all transactions in 2019.

Credit: Canada; Technology Strategies International; 2019; 1,790 respondents; among those who had purchased online in the past 12 months; multiple answers were possible © Statista 2020

However, the crisis is not just affecting consumers. With less cash to spend, retail stores are also taking a huge hit. Fortunately, Canadian businesses do have access to increased credit thanks to the Business Credit Availability Program (BCAP), Canada Emergency Business Account (CEBA), and other economic initiatives. That said, delays in certain government benefits could cause many retailers to close their doors for good.

Delays in Government Benefits

While Canadian citizens also have access to emergency government funds, the application process and wait times have left millions of individuals without a stable income for weeks at a time. This means that credit cards are being used in place of cash and debit cards. Consumers are turning to credit to pay for just about everything — from groceries to rent.

Right now, credit cards are a necessity for a lot of Canadians, but they also pose a financial risk. Nobody knows exactly how long the Coronavirus pandemic will continue, but many experts believe that there will not be a vaccine (or economic stability) for at least a year. Relying on credit cards and unemployment benefits for months at a time could be the only solution for many until day-to-day life returns to normal.

Tips to Stay Afloat

In this time of financial hardship and uncertainty, Canadians must remember not to overextend themselves. Acting responsibly and budgeting carefully could make the difference between weathering the storm successfully and experiencing long-term financial instability. So, here are a few tips to help Canadian consumers maintain fiscal responsibility during this crisis:

● Don’t use all of your cash reserves immediately – If you have cash on hand, consider yourself lucky. However, you shouldn’t spend all of your cash first. Instead, try to strike a balance between cash and credit. This way, if an emergency comes up that requires cash, you will have cash on hand to deal with it.

● Don’t overdo your debt repayment – Usually, paying more than the minimum on your credit cards is a good thing. However, in a time when your cash flow could be inconsistent, you shouldn’t spend extra cash unless it’s absolutely necessary. Pay what you can without taking away too much from your available funds.

● Dip into your savings if necessary – COVID-19 presents the biggest crisis of our generation. If there’s ever been an emergency that required drastic measures, this is it. While you don’t want to drain all of your savings or retirement fund, you shouldn’t be afraid to take out some cash when you really need it.

● Don’t be afraid to ask for help – The Canadian government has instituted a number of programs to help individuals get food, medicine, and money during this crisis. Research which benefits you are eligible for and apply as soon as possible.

To learn more about COVID-19 programs for individuals and businesses, consult Canada’s COVID-19 Response Page.